Where Innovation and Insight power a different conversation

BNY Mellon Markets offers differentiated value through our fully integrated Liquidity, Financing and Execution solutions. Our privileged leadership role in global financial markets provides us with an exceptional vantage point to help support you in achieving your investment goals.

With a legacy of client and industry trust for nearly 240 years, solving for your unique needs is our priority.

Markets: Our Expertise

Liquidity

& Financing

Execution

Services

- Global access to FX

- Fixed Income and Equities markets

- Capital markets

- Program services

- Buy-side trading

- Portfolio transition services (Coming soon)

Markets by numbers

Markets

BNY Mellon

All annual data numbers are based on 2022; all other data points, unless otherwise stated, as of Q4 2023. Largest Agency Securities Lending Program as measured by on-loan assets according to S& Global Market Intelligence Securities Finance as of 3Q 2023.

News

New Podcast Women in Alts: Empowering Change and Advancement

Whether it’s holding key leadership positions, bringing diverse thinking to an investment strategy, or helping develop female talent, women are making an impact across the alternative investments industry. Join us for an in-depth look at the positive momentum behind this trend.

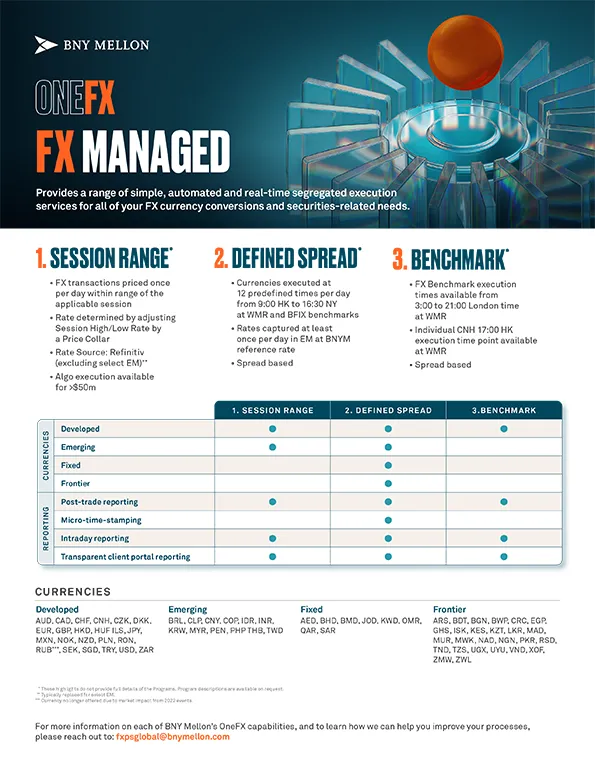

Now available Universal FX

This new automated solution allows third-party clients to have control over their execution, regardless of where they custody, prime broker or settle trades.

LiquidityDirect White label service

We are excited to announce LiquidityDirect's White Label service. This new offering allows institutional clients to provide a holistic liquidity management solution to their end clients, backed by the power of the market leading LiquidityDirect platform.

Where innovation and insight power a different conversation.

To ensure you see multiple perspectives, we provide you with access to unique data on investor flows and behavior, as well as market-leading thought leadership that takes you inside the forces that are driving today's markets.

INSIGHTS

If you're looking for a unique vantage point drawn from an independent perspective, Aerial View is the indispensable field guide for you. Informed by intelligence from industry experts, our diverse roster of clients as well as our in-house economists and strategists, it gives you the inside track on the issues you need to be thinking about.