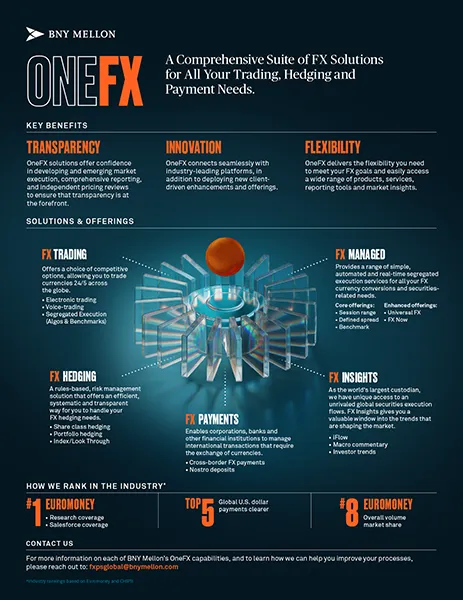

ONE FX

ONE FX

Transparency

OneFX solutions offer confidence in developing and emerging market execution, comprehensive reporting, and independent pricing reviews to ensure that transparency is at the forefront.

Flexibility

OneFX connects seamlessly with industry-leading platforms, in addition to deploying new client driven enhancements and offerings.

Innovation

OneFX delivers the flexibility you need to meet your FX goals and easily access a wide range of products, services, reporting tools and market insights.

Our Solutions & Offerings

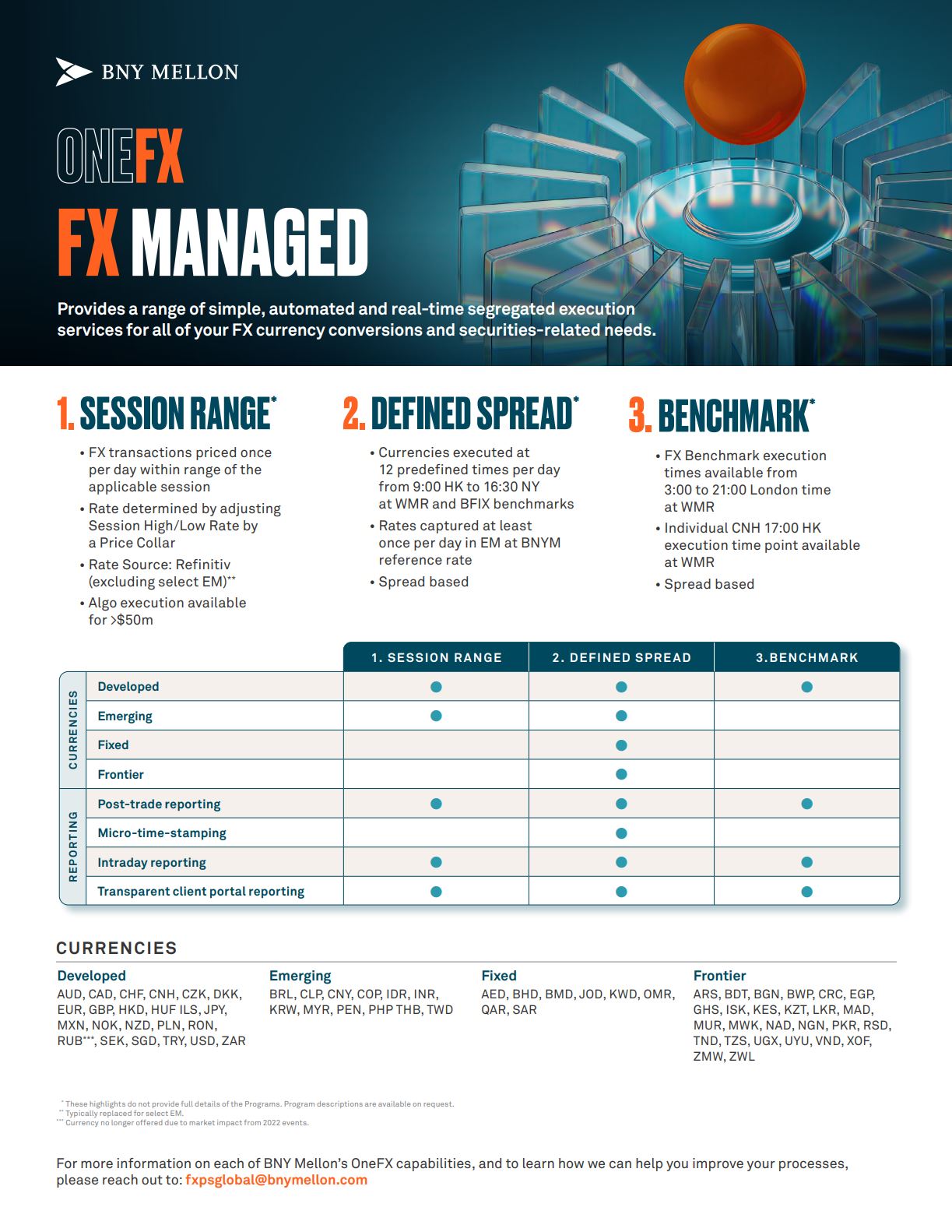

FX Managed

Provides a range of simple, automated and real-time segregated execution services for all your FX currency conversions and securities related needs.

Core offerings:

- Session range

- Defined spread

- Benchmark

Enhanced offerings:

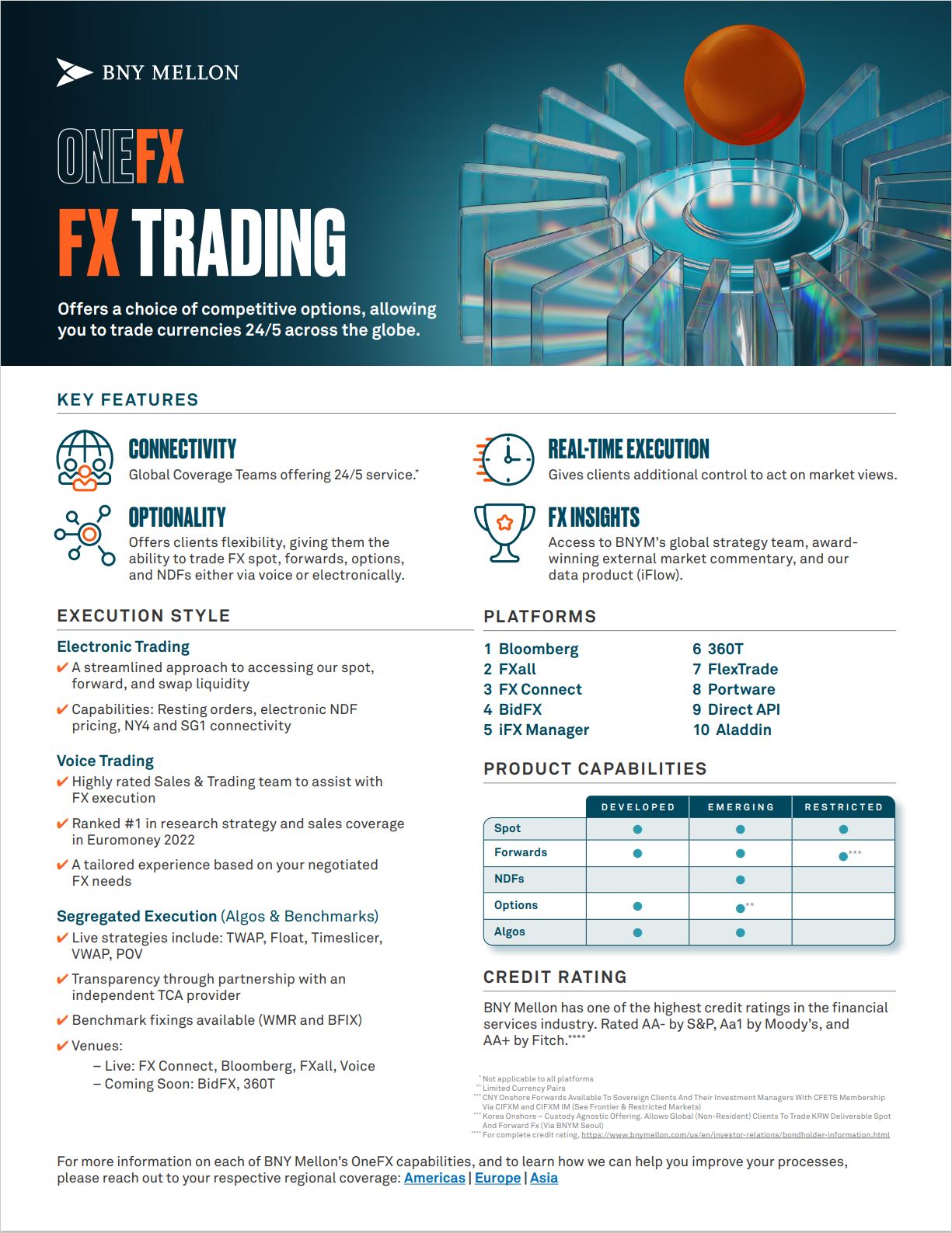

FX Trading

Offers a choice of competitive options, allowing you to trade currencies 24/5 across the globe.

- Electronic trading

- Voice-trading

- Segregated Execution (Algos & Benchmarks)

- FX Algos- Algo Order Strategies

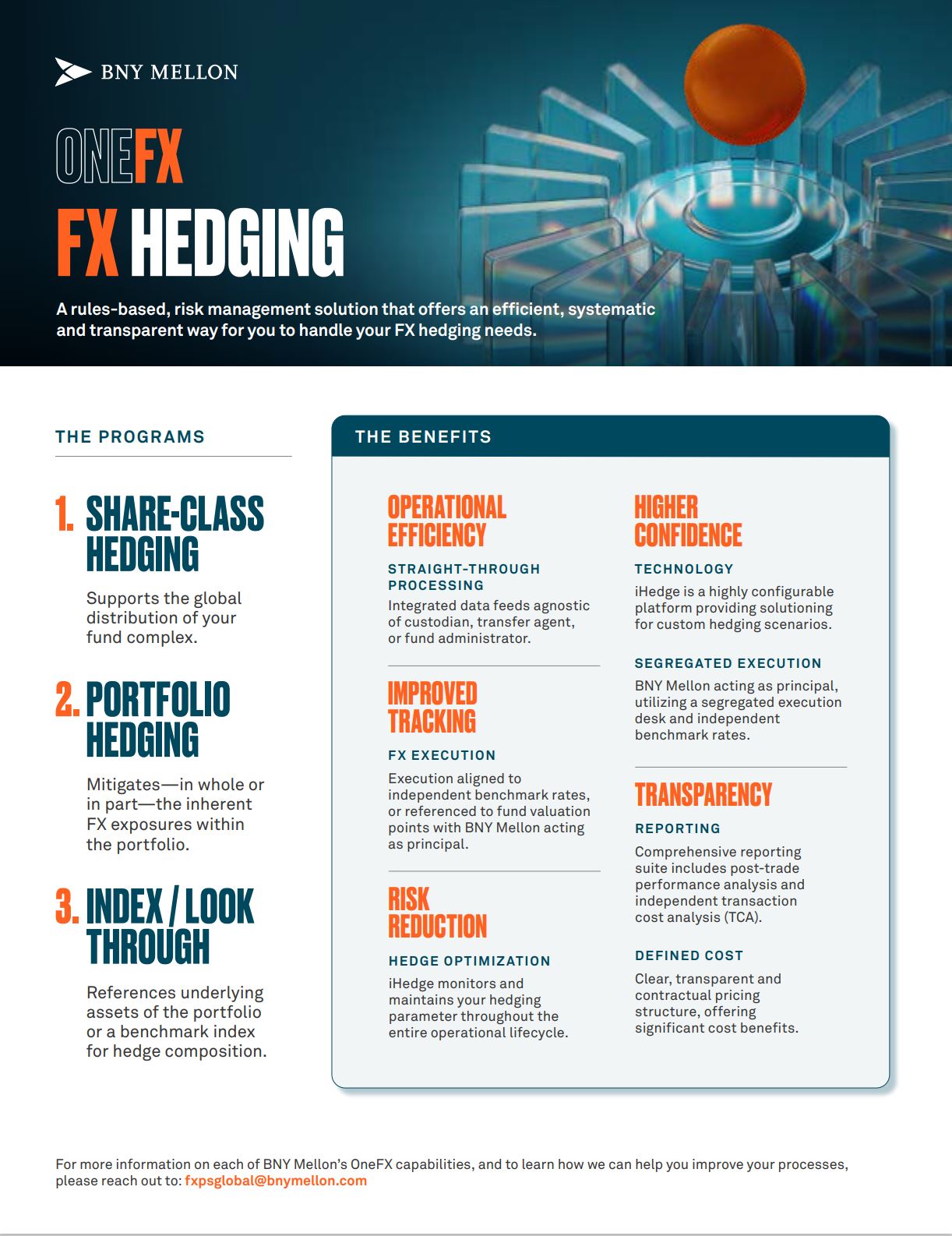

FX Hedging

A rules-based, risk management solution that offers an efficient, systematic and transparent way for you to handle your FX hedging needs.

- Share class hedging

- Portfolio hedging

- Index/Look Through

FX Payments

Enables corporations, banks and other financial institutions to manage international transactions that require the exchange of currencies.

- Cross-border FX payments

- Nostro deposits

FX Insights

As the world's largest custodian, we have unique access to an unrivaled global securities execution flows. FX Insights gives you a valuable window into the trends that are shaping the market. Learn more.

- iFlow

- Macro commentary

- Investor trends

At A Glance

Enjoy the convenience of our transparent, innovative, and flexible suite of FX solutions for all your trading, hedging, and payment needs.

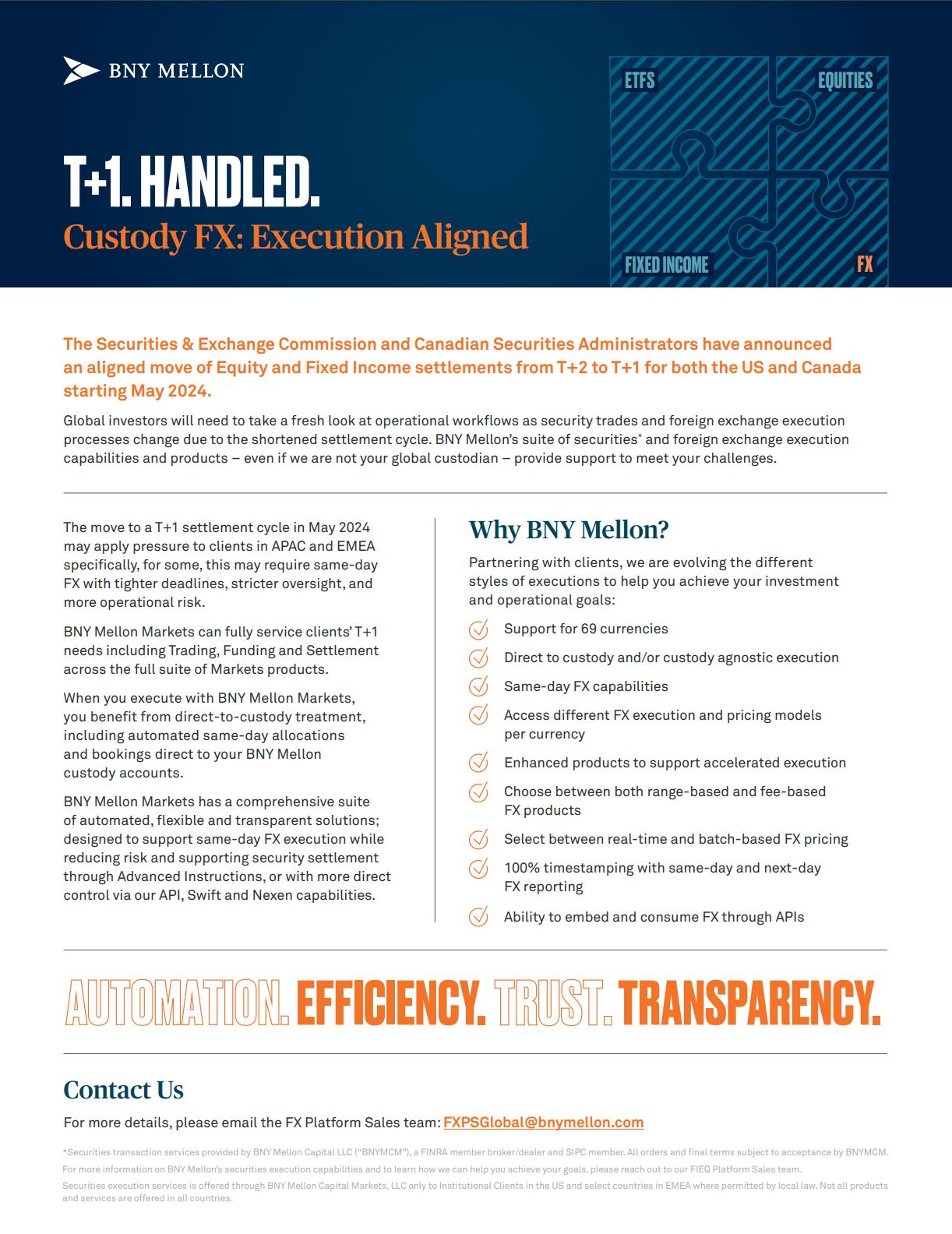

T+1. Handled.

Ahead of the upcoming transition to a shortened settlement cycle, we developed strategies and solutions to help you seamlessly navigate the change.

View our T+1 FX document, or download our FAQ sheet.

Our Experts

Jason Vitale

Global Head of FX, Fixed Income & Equities

Harry Moumdjian

Global Head of FX, Fixed Income and Equities Sales

Ed McGann

Global Head of FX Platform Sales

Jordan Barnett

Global Head of FX Program Trading, Platforms and Product