Collateral and Financing Solutions For a Changing Market

Optimize Your Collateral and Find Efficiencies

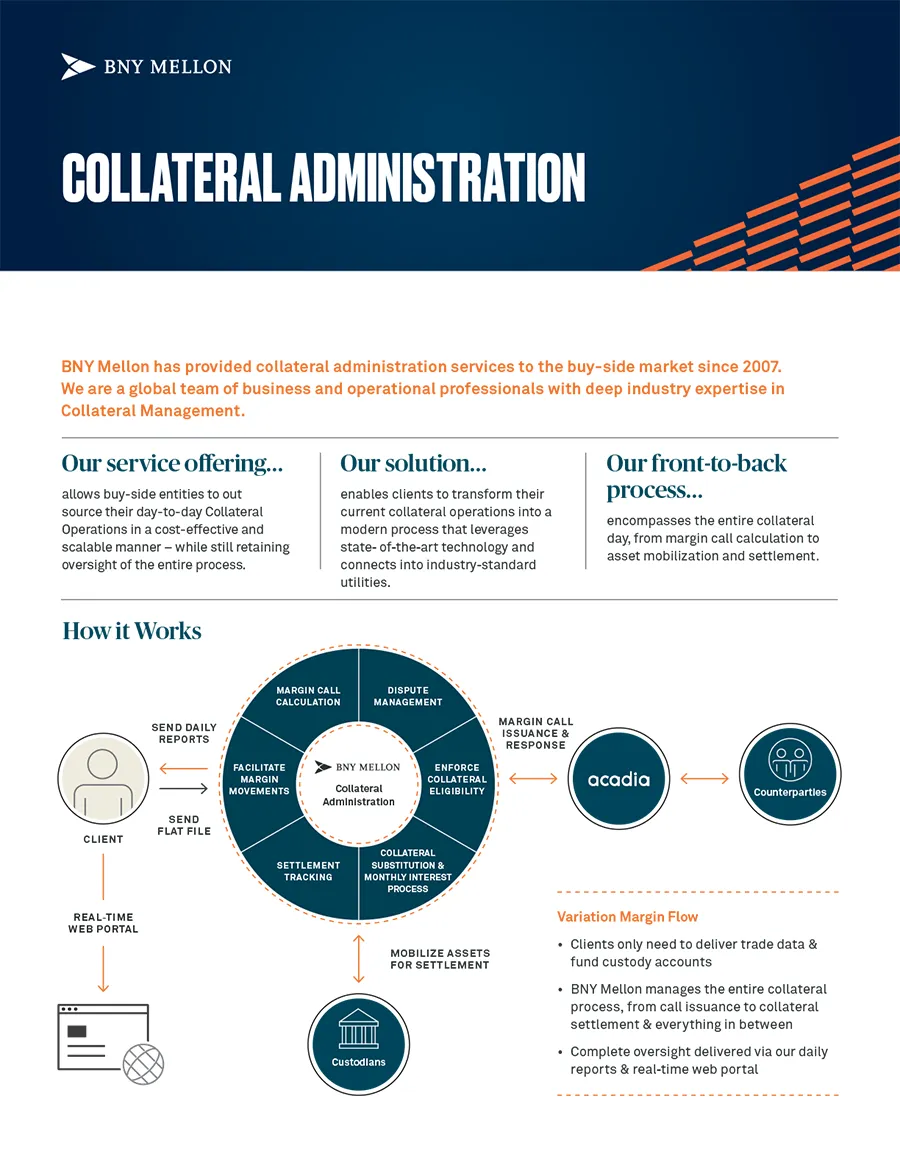

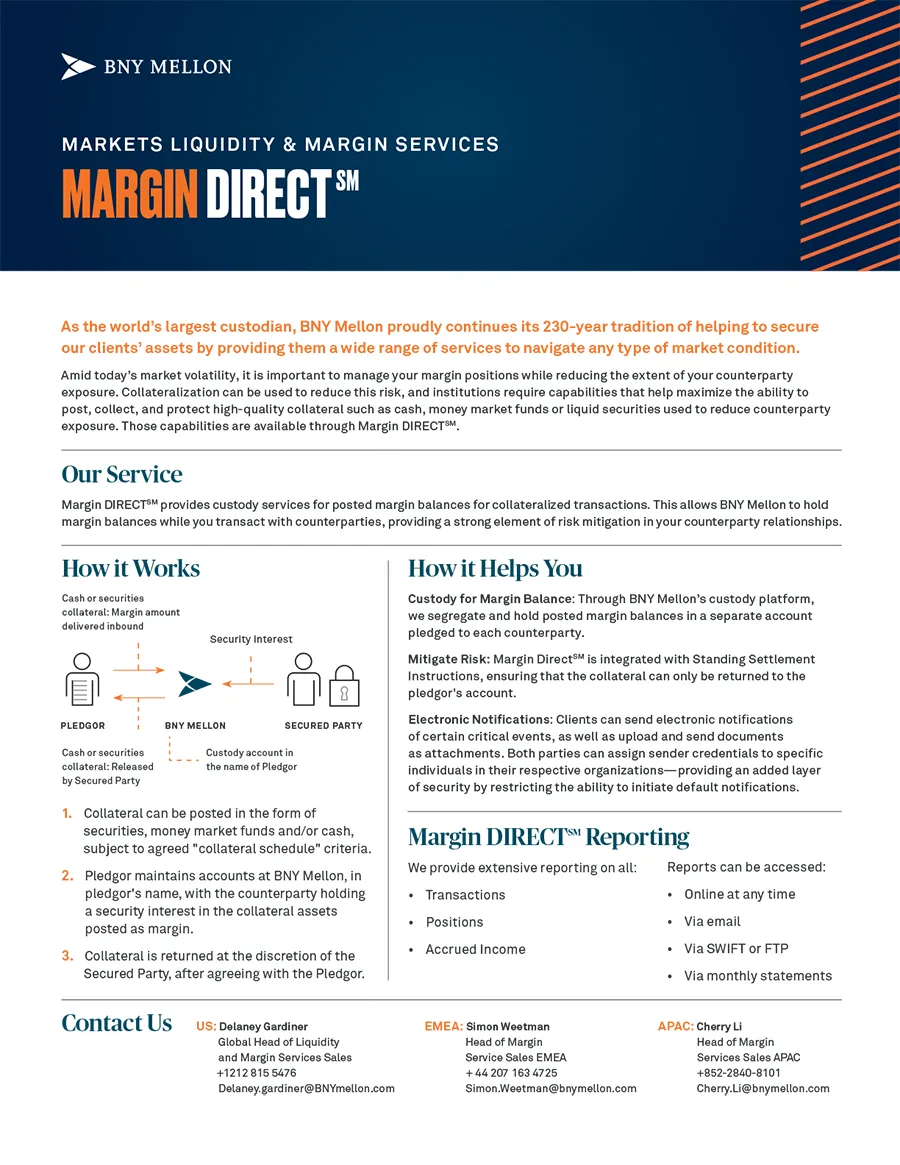

BNY Mellon’s Margin Services helps clients efficiently manage collateral using innovative solutions for both collateral providers and receivers. As a global provider, we help buy-side and sell-side clients optimize their collateral portfolios with sophisticated analytics and eligibility tools, as well as flexible bilateral and triparty solutions, while meeting increasingly complex financing and liquidity requirements.

Our Collateral and Financing Solutions

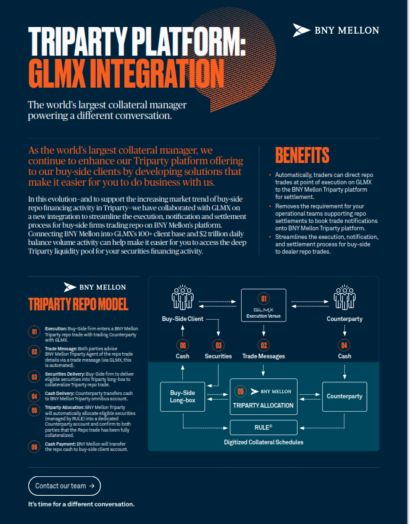

We have made enhancements to our Triparty platform offering by developing solutions that make it easier for you to do business with us. In this evolution—and to support the increasing market trend on buy-side repo financing in Triparty—we have collaborated with GLMX on a new integration to streamline the execution, notification, and settlement process.

Our Solutions

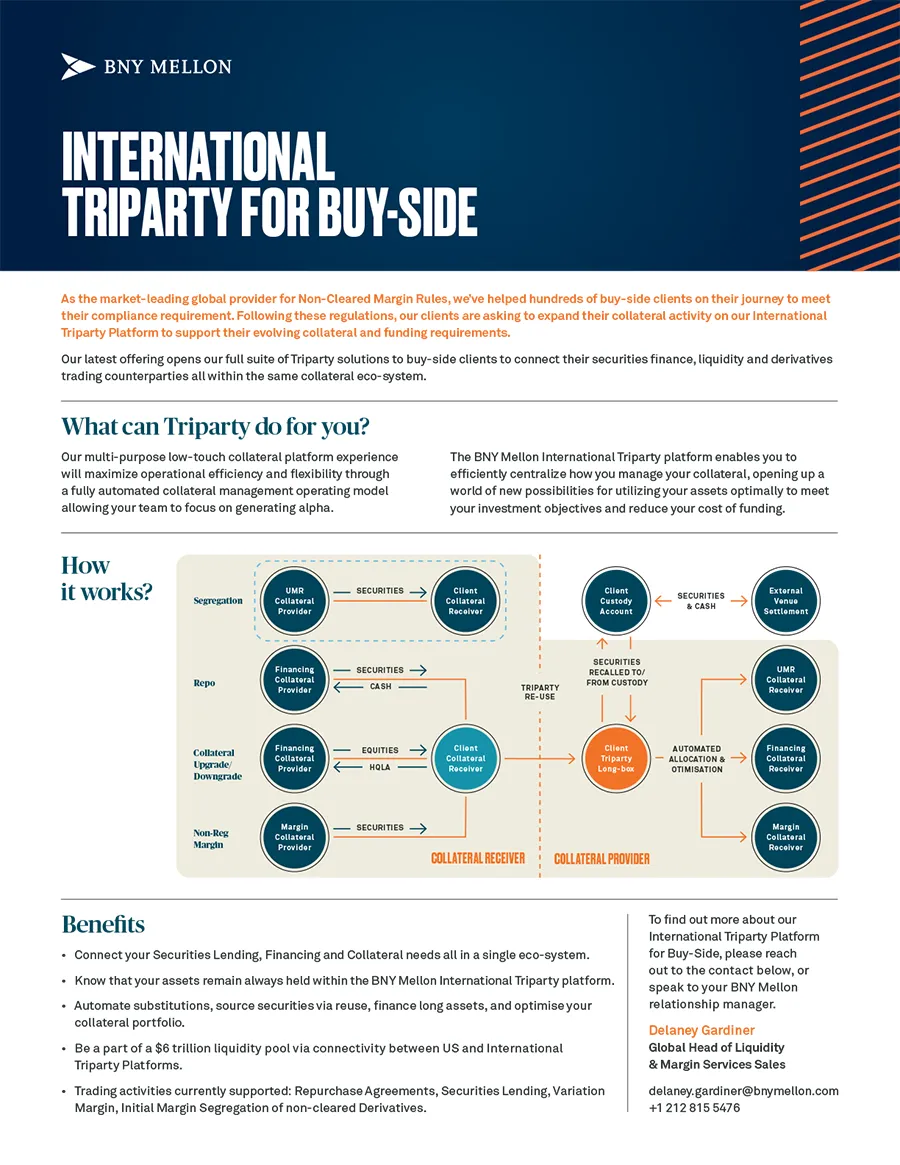

Expand their collateral activity on our International Triparty Platform to support their evolving collateral and funding requirements.

Our latest offering opens our full suite of Triparty solutions to buy-side clients to connect their securities finance, liquidity and derivatives trading counterparties all within the same collateral eco-system.

Navigating the Regulatory Maze

Compliance with the margin requirements is a journey. We’ve helped hundreds of clients meet their compliance requirements. See below to learn how we can help guide you through these regulations.

Uncleared Margin Rules

The Uncleared Margin Rules require counterparties in non-cleared over-the-counter (OTC) derivative trades to exchange initial margin (IM) and variation margin (VM) with each other.

These rules began life in 2009, when the G20 countries committed to reforming the OTC derivatives market in the wake of the financial crisis. The G20 agreed to two major reforms: The first was that standardized derivatives would be cleared at central counterparties. The second was that non-standardized derivatives unsuitable for central clearing would be subject to IM and VM requirements.

In the years since, the rules have been codified as legally binding regulation in Australia, Canada, the European Union, Hong Kong, Japan, Korea, Singapore, Switzerland and the United States.

Am I Captured?

Determining whether you are captured under the rules is based on whether your average aggregated national amount (AANA) of non-cleared OTC derivatives exceeds a certain threshold over a certain period of time.

Take the test to find out how the Uncleared Margin Rules impact you.

The Journey

If you are captured, the rules will impact the entire lifecycle of your trade from inception through to post trade settlement. Here, you can learn about the individual steps toward compliance, explained simply across Pre-Trade, Exchange, and Settlement.

FINRA 4210

On May 22, 2024, firms who trade bilateral Covered Agency Transactions will be required to exchange Market to Market Variation Margin on a daily basis.

Covered Agency Transactions include:

- To-be-announced (TBA) trades: TBA trades account for the majority of trading in the agency mortgage backed securities (MBS) market.

- Specified Pool transactions: For transactions in which the settlement date is more than one business day after trade date.

- Collateralized Mortgage Obligations (CMO): For transactions in which the settlement date is more than three business days after trade date.

Resources

Additional webinars and readings related to the Uncleared Margin Rules.

Webinars

Readings

ISDA: Ready for IM Regulatory Requirements

This online tool provides buy-side firms with legal review on the enforceability of netting and collateral arrangements in key jurisdictions across the globe.

EU Regulation on Uncleared Derivatives

Read the EU regulation that brought the Uncleared Margin Rules into force in Europe.

CFTC Final Rules on Margin Requirements for Uncleared Swaps

You can find the CFTC rule enforcing the margin requirements in the US here.

Our Experts

Laide Majiyagbe

Head of Financing and Liquidity

Ted Leveroni

Head of Global Margin Services

Sean Lynn

Global Head of Collateral Administration Product

Nick Kurzel

Buy-Side Strategy & Product Management

Delaney Gardiner

Global Head of Liquidity & Margin Services Sales

Mark Bellward

Head of Liquidity & Margin Services EMEA

Mark Higgins

Head of Product Development EMEA

Cherry Li

Head of Liquidity & Margin Services APAC